Navigating a global pandemic from a professional and a personal perspective has and continues to be a monumental challenge.

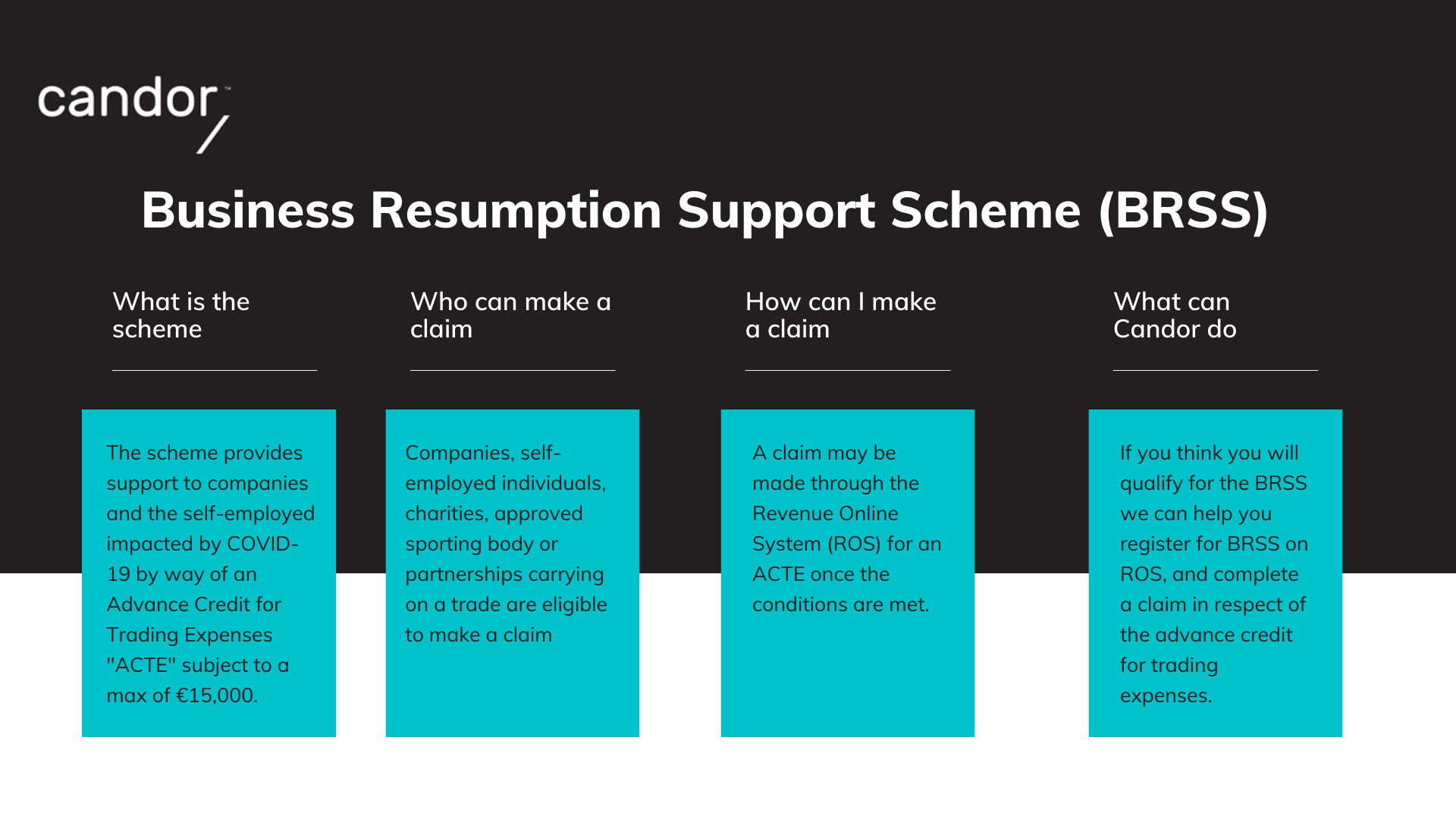

The Irish Revenue Commissioners acknowledge the significant difficulties that businesses are facing. In response, the Business Resumption Support Scheme (“BRSS”) was announced. It is a targeted support for businesses significantly impacted by COVID-19 restrictions introduced by the Government. The scheme is available to eligible businesses, who meet the specific criteria.

Regardless of whether you previously qualified for other COVID-19 Government schemes, you may still qualify for BRSS.

Has your turnover reduced by 75% compared to 2019 as a result of public health restrictions? If so you may be able to apply to Revenue for a cash payment to help you get back up and running.

What help is offered?

You can make a claim under the scheme for payment, known as an “Advanced Credit for Trading Expenses (‘ACTE’)”, in an amount equal to three times the sum of:

- 10% average weekly turnover up to €20,000; and

- 5% of any excess of average weekly turnover above €20,000

subject to a maximum payment of €15,000.

How can Candor help?

There are a number of conditions which must be considered in determining whether you will qualify for the scheme. As such, we are here to help every step of the way, ensuring you receive the maximum support available. Claims under the scheme may be made from 1 September 2021.

Our specialist tax team will analyse whether you qualify, register you for BRSS and submit the claim on your behalf.

Candor Conclusion

The introduction of the BRSS is greatly welcomed. We need to take care of our SMEs who are the backbone of Irish society. According to data from the CRO prior to the global pandemic, over 1 million people in Ireland are employed by SMEs. Ireland is a country full of opportunities, entrepreneurs and resilient individuals. At Candor we want to continue to help anyone navigate these unprecedented times.

Patrick Donnellan, Partner Candor

Conversations with Candor – Webinar

If you want to learn more about BRSS join our free webinar in August by registering above. Don’t worry if you can’t make the webinar, we will send you the replay but registration in advance is required.

Contact Candor

If you would like to discuss the potential impact of the above scheme on you or your business, or other COVID-19 supports, please get in touch with our specialist Tax team by calling 091 75 82 82 or email Sophie on ssweeney@candor.ie to find out more information on how we can help you.

Candor - In your corner

Our professional expertise combined with your goals can ensure successes