If you are the owner of a residential property on 1 November 2021, then you are liable for Local Property Tax (LPT) for 2022 on the property.

The value of the property for LPT purposes should be based on the value at 1 November 2021. This will be the value of your property for the four-year period from 2022 to 2025.

You are also required to file a LPT return by 7 November 2021. The LPT return will apply to the valuation period from 1 January 2022 to 31 December 2025.

How do I value my property on 1 November 2021?

LPT is a self-assessed tax, which means you need to determine the value of the property yourself at 1 November 2021. Revenue have provided a valuation tool and guidance which will help you in determining the value of your property on this date. Access the tool here.

You may also use publically available information in determining the value of your property, such as Daft.ie, myhome.ie, the Residential Property Price Register which shows the price of properties that have been sold in your area, obtain a valuation from a professional valuer or local estate agents.

How do I file my LPT return?

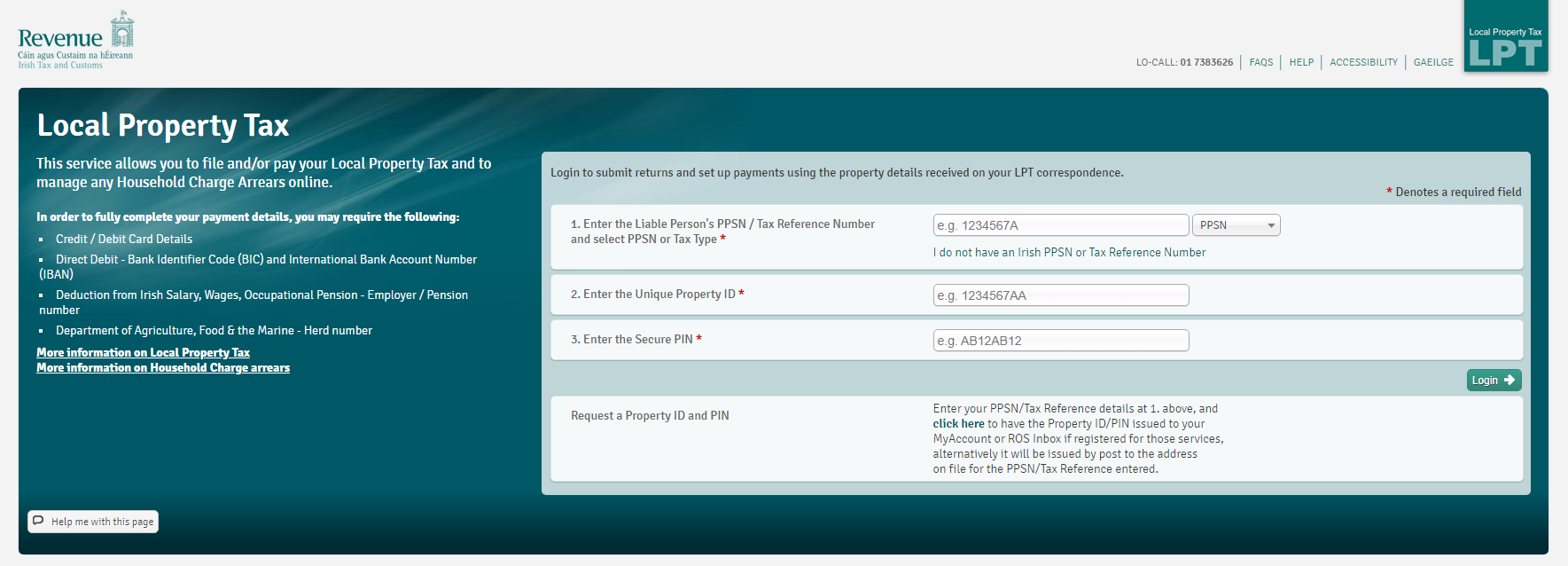

You should have received a letter from Revenue through your Revenue myAccount, the Revenue Online Service or the post. This letter will include your Property ID and PIN which will allow you to file your LPT return online. If you have not been contacted by Revenue, you still may have a obligation to file a LPT return, therefore, you should contact the Revenue LPT branch on 01 738 3626.

Once you have your Property ID and PIN, visit the LPT Revenue site and follow the steps. The site can be accessed here.

How do I pay my LPT liability?

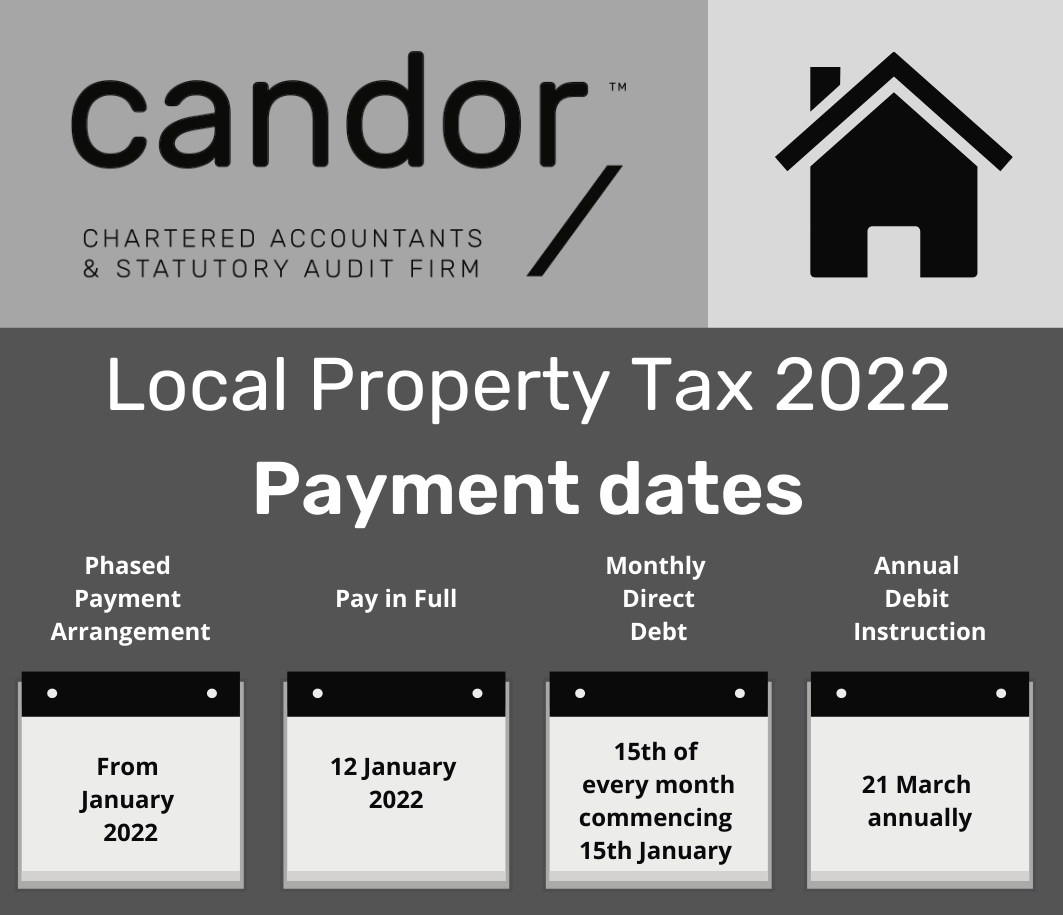

You have four options in paying your LPT liability.

- Phased Payment Arrangement – spread your payments during 2022

- Single payment in full – one off payment by cheque or an approved Payment Service Provider

- Direct Debit – monthly direct debit

- Annual Debit Instruction – annual payment

Contact us today

Candor are here to help in the preparation and filing of your LPT return.

If you have any queries, please do not hesitate to reach out to a member of our tax team by scheduling a consultation at a time that suits you here.